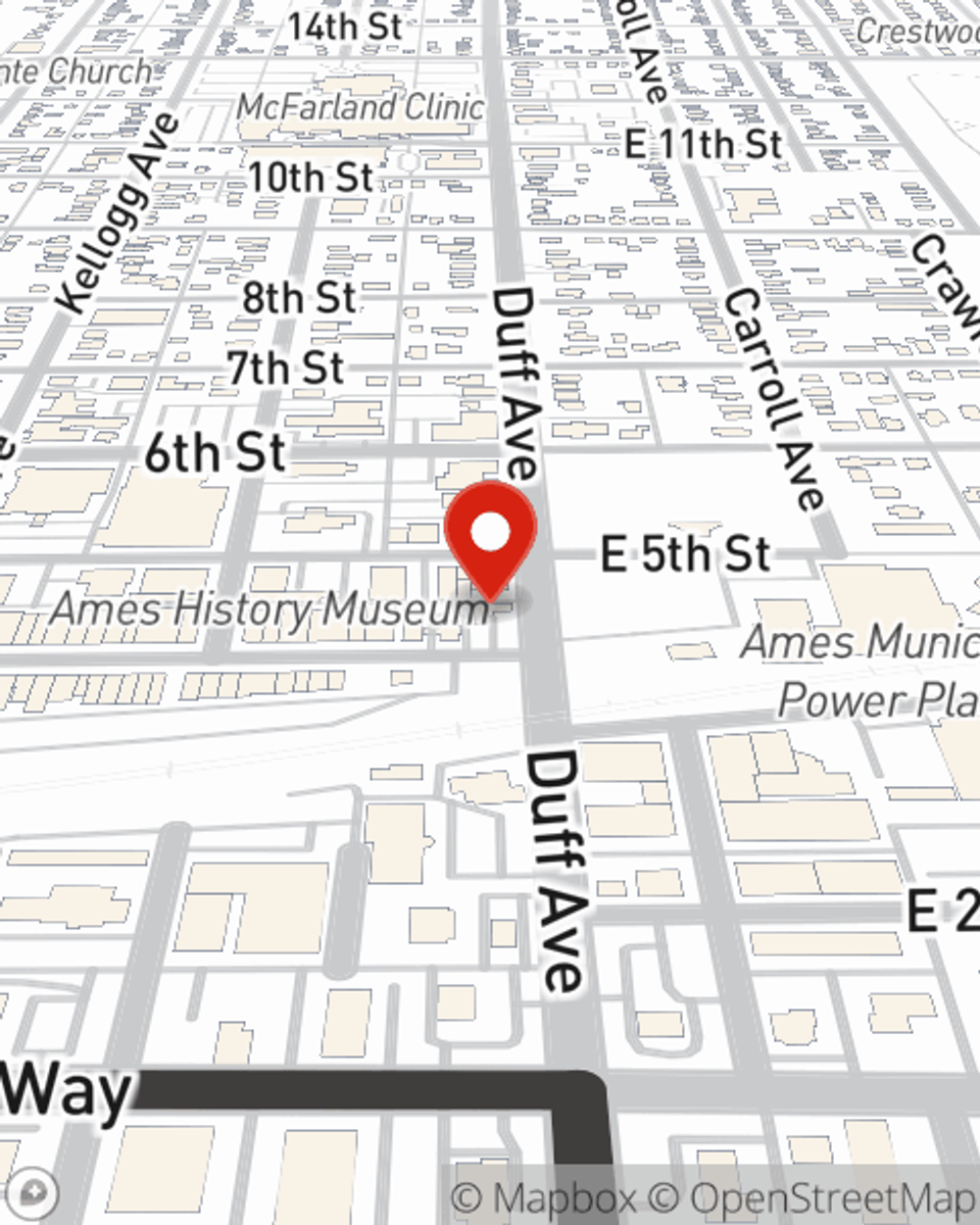

Business Insurance in and around Ames

Looking for coverage for your business? Search no further than State Farm agent Scott Richardson!

Insure your business, intentionally

Insure The Business You've Built.

Running a business is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for everyone you care for. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, errors and omissions liability and extra liability coverage.

Looking for coverage for your business? Search no further than State Farm agent Scott Richardson!

Insure your business, intentionally

Cover Your Business Assets

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Scott Richardson for a policy that covers your business. Your coverage can include everything from extra liability coverage or errors and omissions liability to group life insurance if there are 5 or more employees or professional liability insurance.

Reach out agent Scott Richardson to talk through your small business coverage options today.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Scott Richardson

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.